Best retirement calculator for couples

I guess it makes sense that the American Association of Retired Persons AARP would have a retirement calculator. How couples who save together can max out their pensions.

The 10 Best Retirement Calculators Newretirement

Get all these features for 6577 FREE.

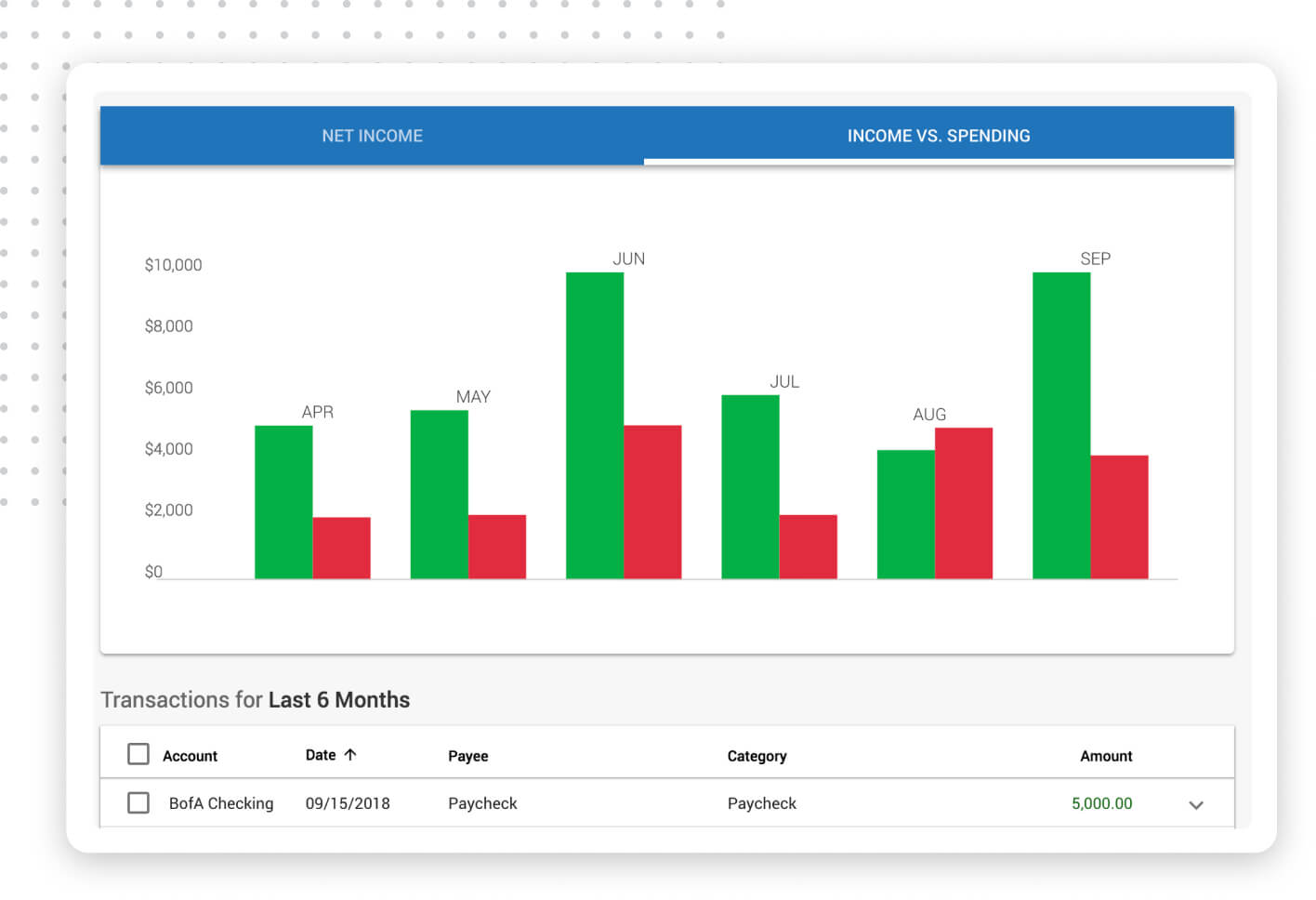

. When it comes to retirement planning Americans are often way behind. Best available This refers to a group of writers who are good at academic writing have great writing skills but are new in our team of. On average someone under age 25 is saving less than 7000 while someone between ages 55 and 64 averages just over 232000.

Best Savings Account Rates. This calculator assumes that the year you retire you do not make any contributions to your retirement savings. Essay Help for Your Convenience.

Receive your papers on time. One of the best if not the best such calculator. However the calculator allows you to adjust these assumptions if you think you can do better.

Find out the ones that work best for. Retirement savings wont automatically be split 5050 though. See more about special considerations regarding retirement calculator for couples Expenses.

When it comes to finding the best specialist for your paper there are 3 categories of specialist that we have to look at. After your retirement plan assets are divided youll need to send a Qualified Domestic Relations Order to your plan administrator. Retirement calculators vary in the extent to which they take taxes social security pensions and other sources of retirement income and expenditures into account.

We cover any subject you have. Generally one member of a. Buy the best term insurance plan policy online in India with 12 Cr life cover at less than 31day covering COVID-19 life claims 36 critical illnesses disability.

Most retirement calculators ask very few questions and make a. 1091 The best writer. Use this 1040 tax calculator to help estimate your tax bill for the current tax years rates and rules.

Kudos for this gift to all. After retirement your spending is likely to evolve. In fact it is the best in the world according to the World Economic Forums 2020 Global Competitiveness Report and it placed second in International Livings 2022 Global Retirement Index.

Age at retirement Age at which you plan to retire. When deciding which pension payout option is best for you and your spouse consider your life expectancy potential beneficiaries and their life expectancies and your income needs in retirement to determine whether an annuity or a lump-sum. One element that may be too hard to add but would be helpful if possible is to account for couples.

Generally you cant contribute to an individual retirement account IRA unless you earn an income in a given year. Eight tips from the experts on gaining the perks while. 103050 for married couples filing separately plus 28 of.

The assumptions keyed into a retirement calculator are critical. Set the deadline and keep calm. 7 min read Sep 06 2022 A retirees guide to hosting on Airbnb.

Compound Interest Calculator Best Savings Accounts Best CD Rates Best Banks for Checking Accounts. Our writers are able to handle complex assignments from their field of specialization. The spousal IRA however is an exception to this rule allowing each spouse.

The best way I can describe the issue is the probability of at least one spouse living to 95 is 25 same age right at retirement age 66. This data breaks down individual balances by age group but for married couples targets will differ depending on the couples age household income and whether there is a sole earner or dual income. A guide to self-invested personal pensions and boosting your retirement investing.

In fact in 2019 almost half of households headed by someone 55 or older had no retirement savings at all according to the U. Youll need to input how much you extra you expect to get in the retirement income field. Once you turn age 59 12 you can withdraw any amount from your IRA.

Claim early due to health concerns A couple with shorter life expectancies may want to claim earlier. Even so a survey by Fidelity Investments discovered that many married couples have an extremely difficult time discussing retirement planning and other financial planning subjects. Any Deadline - Any Subject.

For example from your personal savings NOT a retirement account distributions from the annuity will have the taxable portion reduced by the amount paid for the annuity. AARP is the largest non-profit advocacy group for retirees in America. Make sure you use a retirement calculator that allows you to customize different phases with different levels of spending.

Not all retirement plans are equal. Here are some top strategies for withdrawing your retirement funds from three planning experts. Why a Retirement Calculator for Couples Can Really Help You If you are in a relationship you are familiar with two important concepts.

Bloomberg s recent post-pandemic efficiency listing for healthcare puts Spains single-payer public health system in 16th place. They offer a simple three-step retirement calculator to help you gauge where you are at and what retirement could look like. Factor your decision into your overall retirement income plan.

Couples planning on a shorter retirement period may want to consider claiming earlier. For example if you retire at age 65 your last contribution occurs when you are actually age 64. One of the most important assumptions is the assumed rate of real after inflation investment return.

It sets pension fund returns at 53 a year before fees for high growth investments 48 for balanced and 38 for conservative investments. Benefits are available at age 62 and full retirement age FRA is based on your birth year. Our retirement calculator takes into account the average Canadian retirement income from the Old Age Security OAS and Canada Pension Plan CPP for 2018.

Determine when its best to claim and on which record. From its beginnings in the days of President Franklin Roosevelt Social Security has held fast that spouses and ex-spouses have a claiming right to retirement benefits. Thats because this type of individual retirement account comes with tax-free withdrawals a huge advantage that gives you more.

Who it may benefit. 9 best retirement plans in September 2022. The Roth IRA is a unique and powerful tool for retirement savings.

ASICs MoneySmart Retirement planner calculator assumes more conservative estimates based on actuarial advice. You can avoid the early withdrawal penalty by waiting until at least age 59 12 to start taking distributions from your IRA. And if you are among the tens of millions who are.

The exact split is decided either in mediation between the two parties or by a judge during the divorce trial. This calculator also assumes that you make your entire contribution at the end of.

The 10 Best Retirement Calculators Newretirement

Retirement Planning

Retirement Saving Excel Template Savings Calculator Money Management Retirement Savings Calculator

The 10 Best Retirement Calculators Newretirement

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Fire Calculator When Can I Retire Early Engaging Data

The 10 Best Retirement Calculators Newretirement

401k Calculator For Excel 401k Calculator Savings Calculator Spreadsheet Template

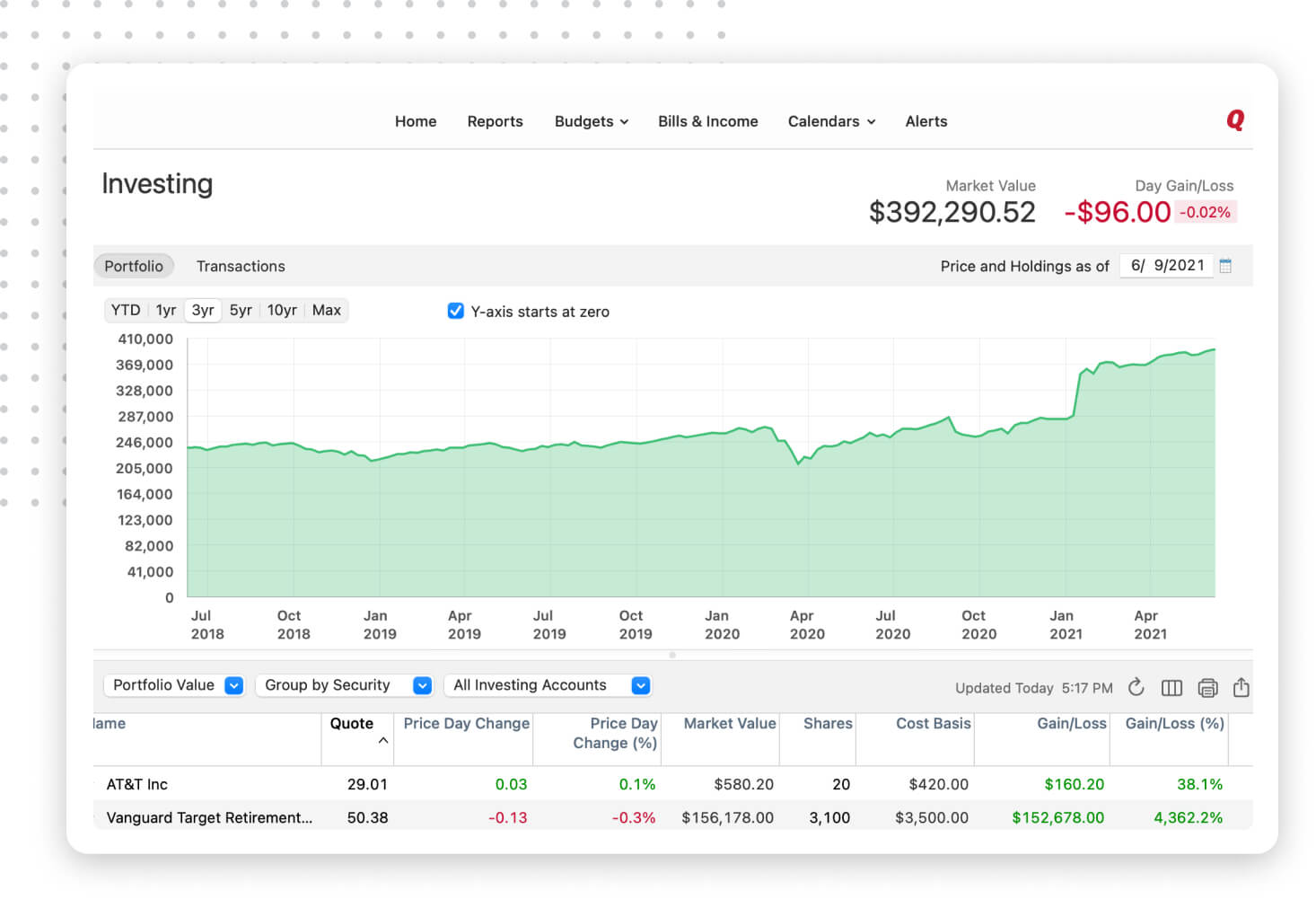

Quicken Retirement Planning Software Plan Your Retirement Today

Quicken Retirement Planning Software Plan Your Retirement Today

The 10 Best Retirement Calculators Newretirement

Newretirement Savings Timeline Retirement Planning Retirement Calculator Planning Tool

How To Calculate How Much Money You Need To Retire

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

The 10 Best Retirement Calculators Newretirement

The 10 Best Retirement Calculators Newretirement

How Long Will My Retirement Savings Last Money Management Tips 2022